Investments are the new trend. Whether it be mutual funds or stocks and shares, people are investing on a much broader scale and much more actively than before. Some are investing for their kids, while others are investing for their parents. Some dream of their own house, while others do so to avoid any emergency in the future. There may be countless reasons, but the only thing you need to count is how many dreams and goals you are going to achieve once your investments mature.

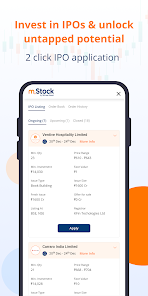

Opening a Demat Khata and brokerage account is a straightforward and crucial first step toward financial growth, even though beginning your stock market journey may initially seem overwhelming. Having the appropriate accounts in place provides you with the basis to take charge of your finances, regardless of your goals: investing in blue-chip stocks from the Nifty 50, taking part in initial public offerings (IPOs), or investigating long-term wealth-building strategies.

To start, there are two types of accounts investors hold.

Your shares and securities are stored digitally in an electronic account called a Demat Khata, which stands for Dematerialized Account.

To store shares, you need to open Demat account, just as you need a savings account to store cash. Although you can open more than one Demat account with a different broker, each one needs to be connected to a separate trading account.

Buying and selling stocks in the market is done through a brokerage account, also known as a trading account. Your investments are kept in a Demat account, but the actual buying or selling is done in a trading account.

You can open both trading and demat accounts with a stockbroker who gives you access to stock exchanges like the NSE and BSE. Usually, both accounts are required to participate fully in the stock market.

Because of its stability and track record of returns, the Nifty 50 (निफ्टी 50) is a good place to start if you’re not sure where to start. The top 50 companies across 13 sectors are represented by the National Stock Exchange’s benchmark index, the Nifty 50. Giants like Reliance, HDFC Bank, Infosys, and TCS are among them.

The Nifty 50 is an excellent starting point for novice investors seeking comparatively steady returns. With the appropriate platform and resources, you can start creating actual wealth.

But an even better starting point is your will to start building well. You are reading this article because you want to start something fresh and strong, and props to you for that.

Investments are the key to security, personal or financial. No hard work is in vain, but it is important to read the market and the related risks carefully to avoid any bad situations.

Keep in mind that all you need to get started is a reliable platform, the correct attitude, and the desire to learn. As your confidence and knowledge increase, you’ll be more capable of making wiser investment choices and gradually expanding your equity portfolio.

Open a trading and Demat account, investigate the markets, and begin creating the financial future you deserve. The first step in your investing journey is to take action now.