Whether for personal usage, company growth, or handling unanticipated expenses—personal or business—a gold loan is among the fastest and most practical choices you have when you really need money. It lets you provide collateral—gold jewelry or coins—and obtain an immediate loan. Unlike other kinds of loans, a gold loan calls for no credit score check and little paperwork. Knowing gold loan eligibility will help you to ensure rapid money, whether your loan application is online or offline.

Why is a Gold Loan popular, and what is it?

A gold loan is a kind of secured loan offered by NBFCs and banks whereby your gold is pledged in return for a loan sum. The weight and purity of the gold you supply determines the loan value. Because they are handled fast and call for less documentation, many people and small enterprises choose gold loans. Gold loans have become rather popular recently, especially among MSME owners and entrepreneurs seeking quick funding free from a drawn-out approval process.

Standard eligibility criteria for a gold loan:

Comparatively to unsecured loans like personal or corporate loans, the eligibility requirements for a gold loan are basic. Usually ranging in age from 18 to 65, any Indian citizen can apply. Your main need is that you own gold—in coins or jewelry form. Most lenders take gold with an 18 to 24 karat quality. For those who might not be qualified for conventional loans like Mudra loans or business loans, this is perfect since there is no required credit score or income verification needed.

Business Loan and MSME Gold Loan

A gold loan is a great quick funding source for MSMEs and small business owners. It enables procurement of merchandise, cash flow management, or handling of seasonal expenses. Although Mudra loan and business loans are great tools for entrepreneurs, their qualifying criteria—audited financials, firm registration paperwork, and a clean credit history—often call for Conversely, a gold loan evaluates just the value of the gold and ignores your company’s credit history or profitability.

How to Apply for a Gold Loan:

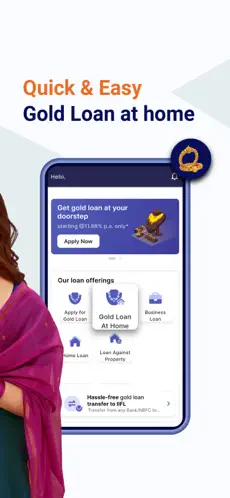

Either visit a branch or choose a digital approach utilizing a gold loan app to apply for a gold loan. The speed and ease of the online approach have made it rather popular. You must register using simple cards like PAN and Aadhaar. Once your information is confirmed, a representative might come visit your house to assess the gold, and the accepted loan amount is directly transferred into your bank account.

Which loan—gold or mudra—better suits your situation?

Though it has more defined eligibility and documentation procedures, a Mudra loan under the Pradhan Mantri MUDRA Yojana is meant to fund micro and small businesses. A gold loan can be a quicker choice for those who require money right now without waiting for government clearance or documentation. It is extremely helpful if you need money for an emergency or to grab an unexpected business opportunity.

Conclusion:

Whether your firm is small, you are an individual, or an MSME seeking quick money, a gold loan provides a hassle-free and quick fix. In India’s changing credit scene, it is a consistent financial tool with low eligibility criteria and quick disbursal.

If you intend to loan apply, thinking about a gold loan could be the best decision for your financial situation.